Dieser Aktienfonds mit aktivem Risikomanagement strebt eine Teilnahme am Wachstum der globalen Aktienmärkte bei gleichzeitig verringertem Rückschlagsrisiko an. FTC Gideon I investiert nach Nachhaltigkeitskriterien (ESG gem. Art. 8 der Offenlegungsverordnung) in Einzelaktien und in vom Aktienmarkt abhängige Futures. Die Kombination sorgt für ein breit diversifiziertes Aktienportfolio und einen gewissen Schutz während ausgprägten Stress-Phasen.

FTC Gideon I: Performance

FTC Gideon I (T)

ISIN: AT0000499785

Kurs per 13.10.2025

19,28

Zum letzten NAV

-2,77 %

Monat

-0,46 %

Laufendes Jahr

-0,41 %

1 Jahr

5,13 %

3 Jahre

39,11 %

5 Jahre

62,70 %

10 Jahre

52,67 %

Seit Auflage

101,29 %

Marketingmitteilung. Die Berechnung der Performance erfolgt nach OeKB Methode auf Basis ausschüttungsbereinigter Rechenwerte. Die hier dargestellte Performance berücksichtigt nicht den einmaligen Ausgabeaufschlag (bis zu 4,0%) und allenfalls individuelle transaktionsbezogene oder laufend ertragsmindernde Kosten (z.B. Konto- und Depotgebühren). Fondsstart war der 16.1.2006. Angaben zur Wertentwicklung beziehen sich auf die Vergangenheit. Die frühere Wertentwicklung ist kein verlässlicher Indikator für künftige Ergebnisse.

10-Jahres-Performance: Die 10-Jahres-Performance bzw. die Performance seit Auflage ist in den auf dieser Seite verlinkten Dokumenten "Performance- und Datenblatt" sowie "Monatsbericht" ausgewiesen.

Datenquelle: FTC Capital GmbH.

Der FTC Gideon I kann zu wesentlichen Teilen in derivative Instrumente (einschließlich sonstige OTC-Derivate) iSd § 73 InvFG 2011 sowie Sichteinlagen oder kündbare Einlagen mit einer Laufzeit von höchstens 12 Monaten investieren.

FTC Gideon I:Dokumente im Format PDF zum Download

Die Aktien-Strategie: Nachhaltig und global diversifiziert

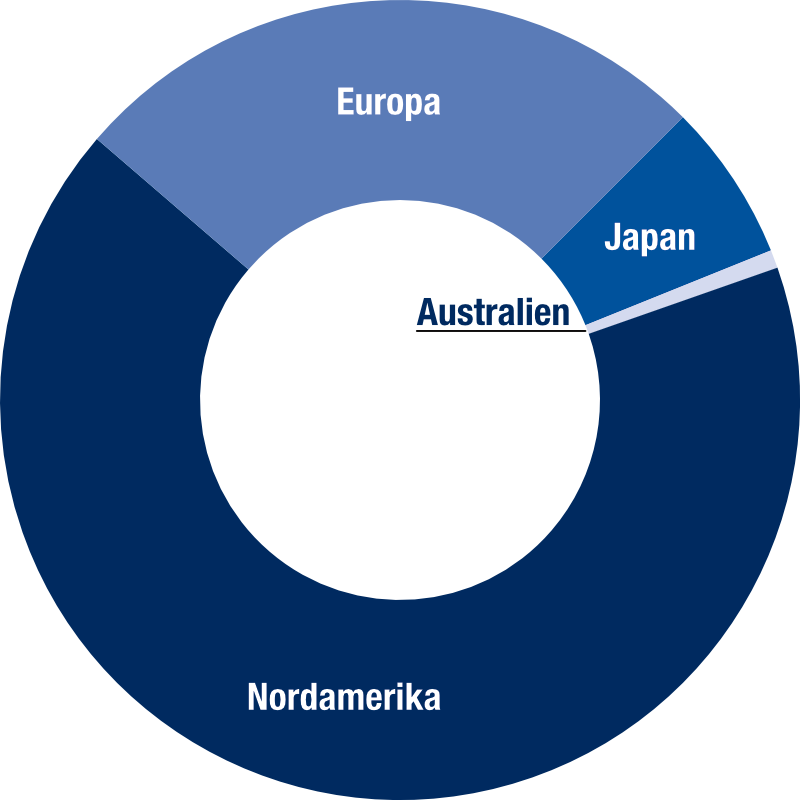

Das Aktienportfolio ist global breit diversifiziert. Investiert wird ausschließlich in hoch liquide Aktien der etablierten Märkte in Nordamerika, Europa, Japan, Hong Kong und Australien. Im Bild: Typische Aufteilung der einzelnen Regionen. Die aktuelle Allokation finden Sie im Monatsbericht. Sie kann auch von der schematischen Darstellung abweichen.

Der Investmentfonds investiert zumindest 51 % des Fondsvermögens in nachhaltige Investitionen im Sinne des Artikel 2 Nummer 17 der Offenlegungsverordnung. Dies wird durch die Einhaltung des Nachhaltigkeitsansatzes des Investmentfonds sichergestellt.

Derivate-Einsatz als Ergänzung und Risikomanagement-Tool

Ein systematischer, regelbasierter Handel mit Futures (börsengehandelte Termingeschäfte), vorwiegend solcher auf Aktien-Volatilität, ergänzt einerseits die Aktienstrategie und ist andererseits ein Element des Risiko-Managments. In ruhigen Marktphasen kann die Futures-Strategie zusätzliche Renditen durch das Abschöpfen von Risikoprämien erzielen. In Stress-Märkten versucht die Strategie, Verluste auf Fonds-Ebene zu begrenzen. Das soll durch das regelbasierte Eingehen von Long-Positionen auf Volatilität erzielt werden.

Rechtliche Hinweise

Der FTC Futures Fund Classic unterliegt nicht der Aufsicht durch eine österreichische Behörde. Der Verkaufsprospekt und das Basisinformationsblatt gemäß der Verordnung (EU) Nr. 1286/2014 wurden von keiner österreichischen Behörde geprüft und keine österreichische Behörde übernimmt die Haftung für Richtigkeit oder Vollständigkeit dieser Unterlagen.

Die Inhalte dieser Website sind Marketingmitteilungen. Sie dienen ausschließlich zur Information und stellen - sowohl nach österreichischem als auch nach ausländischem Kapitalmarktrecht - weder eine Aufforderung, ein Anbot oder eine Annahme zum Abschluss eines Vertrages oder sonstigen Rechtsgeschäftes, insbesondere zu einem Investment, dar oder sollen eine derartige Entscheidung beeinflussen. Jede konkrete Veranlagung sollte erst nach einem Beratungsgespräch erfolgen. Die Inhalte dürfen nicht als Vermögens-, Rechts- oder Steuerberatung ausgelegt werden. Die Informationen wurden von FTC Capital GmbH mit der größtmöglichen Sorgfalt unter Verwendung von als zuverlässig eingestuften Quellen erstellt. Trotzdem kann FTC Capital GmbH keinerlei Haftung für die Richtigkeit, Vollständigkeit, Aktualität oder dauernde Verfügbarkeit der auf ihrer Webseite zur Verfügung gestellten Informationen übernehmen.

FTC Capital GmbH übernimmt keine Haftung für Verluste oder Schäden, einschließlich entgangenen Gewinns oder sonstiger direkter oder Folgeschäden, welche durch den Gebrauch oder das Vertrauen in die auf dieser Webseite zur Verfügung gestellten Information entstehen. Eine Veröffentlichung der enthaltenen Informationen ist untersagt. Angehende Investoren werden angehalten, angemessene Investmentberatung in Anspruch zu nehmen und sich über die geltenden Rechtsgrundlagen, Börsenaufsichtsgesetze und Steuern in ihrem Heimat- oder Aufenthaltsland zu informieren. In jedem Fall sollten die aktuellen, rechtlichen Fondsdokumente (Prospekt, Kundeninformationsdokument, Jahres-, Halbjahresbericht, etc.) sorgfältig studiert werden. Sämtliche fondsspezifischen Dokumente der in dieser Website genannten Fonds (insbesondere Verkaufsprospekte) können kostenlos insbesondere bei FTC Capital GmbH, Seidlgasse 36/3, A-1030 Wien bezogen werden.

Vertriebsbestimmungen:

FTC Gideon I entspricht der EU-Richtlinie 2009/65/EU ("UCITS-Richtlinie"); diverse Anteilklassen sind in Österreich und Deutschland zum öffentlichen Vertrieb zugelassen.

FTC Futures Fund Classic ist ein alternativer Investmentfonds (AIF) gemäß EU-Richtline 2011/61/EU ("AIFM-Richtlinie"). Er darf in Österreich und Luxemburg an professionelle Kunden und an Privatkunden vertrieben werden. In Deutschland ist der Vertrieb an professionelle Kunden zulässig.

Smart Volatility Plus entspricht der Richtlinie 2009/65/EG („UCITS-Richtlinie“). Er darf in Österreich und Deutschland an Privatkunden vertrieben werden.

FTC Systematic Global Trend ist ein alternativer Investmentfonds (AIF) gemäß EU-Richtline 2011/61/EU ("AIFM-Richtlinie"). Er darf in Österreich an professionelle Kunden und an Privatkunden vertrieben werden. In Deutschland ist der Vertrieb an professionelle Kunden zulässig.

Hinweis für die USA:

Die auf diesen Seiten genannten Investmentprodukte und Informationen sind nicht für den Vertrieb in den USA bestimmt. Sie richten sich daher nicht an US-Personen gem. Rule 902, Regulation S, Securities Act 1933 (insbesondere Personen mit amerikanischer Staatsbürgerschaft oder Personen, die ihren ständigen Wohnsitz in den USA haben).

Hinweis für Deutschland:

FTC Futures Fund Classic und FTC Systematic Global Trend sind in Deutschland nicht für den Vertrieb an Privatkunden bestimmt. Damit in Zusammenhang stehende Informationen richten sich daher nicht an deutsche Privatkunden.

Hinweis für die Schweiz:

Die auf diesen Seiten genannten Investmentprodukte sind nicht für den öffentlichen Vertrieb in der Schweiz bestimmt. Die Inhalte dieser Website richten sich daher nicht an Schweizer Staatsbürger.

Mitwirkungspolitik im Sinne §185ff Börsegesetz:

Veröffentlichungen in Zusammenhang mit Art 3 – 5 OffenlegungsVO:

Einrichtungen für den Vertrieb an Privatkunden – Information gem. § 48a AIFMG

Privatkünden können Zeichnungsaufträge zum Kauf von Anteilen am FTC Futures Fund Classic und Rücknahmeaufträge zum Verkauf von Anteilen am FTC Futures Fund Classic über ihre Hausbank abwickeln; erworbene Fondsanteile werden auf das bei der Hausbank geführte Depot des Privatanlegers gebucht. Rücknahmeerlöse werden auf das bei der Hausbank geführte Konto des Privatanlegers gebucht.

Eine Übersicht der Anlegerrechte findet sich im Prospekt des FTC Futures Fund Classic.

Der Prospekt des FTC Futures Fund Classic sowie weitere Fondsdokumente können auf dieser Seite unter der Rubrik "Anlegerinformationen" zur Ansicht und zur Anfertigung von Kopien abgerufen werden.

FTC Capital GmbH fungiert als Kontaktstelle mit der FMA und den zuständigen ausländischen Behörden.