FTC's systematic equity strategy with active risk management strives to participate in the growth of global stock markets and simultaneously reducing the risk of major drawdowns. FTC Gideon I invests in individual stocks and futures which are depending on the stock market. The combination ensures broad diversification and offers a flexible and dynamic risk management.

FTC Gideon I: Performance

FTC Gideon I (T)

ISIN: AT0000499785

as at 17.10.2025

19,33

Compared to the last NAV

-1,13 %

Month

-0,21 %

Year to Date

-0,15 %

1 Year

4,32 %

3 Years

39,57 %

5 Years

63,40 %

10 Years

52,83 %

Inception to Date

101,81 %

Marketing Communication. Performance data refer to the past. Past performance is not a reliable indicator of future results. The performance is calculated according to the OeKB method on the basis of distribution-adjusted calculated values. The performance shown here does not take into account the one-off front-end load (up to 4.0%) and, if applicable, individual transaction-related or ongoing income-reducing costs (e.g. account and custody fees). Fund launch date was January 16, 2006. Performance data refer to the past. Past performance is not a reliable indicator of future results.

Source: FTC Capital GmbH.

FTC Gideon I may invest to a substantial extent in derivative instruments (including other OTC derivatives) within the meaning of § 73 InvFG 2011 as well as demand deposits or term deposits with a term of no more than 12 months.

FTC Gideon I:PDF Documents

The Equity Strategy

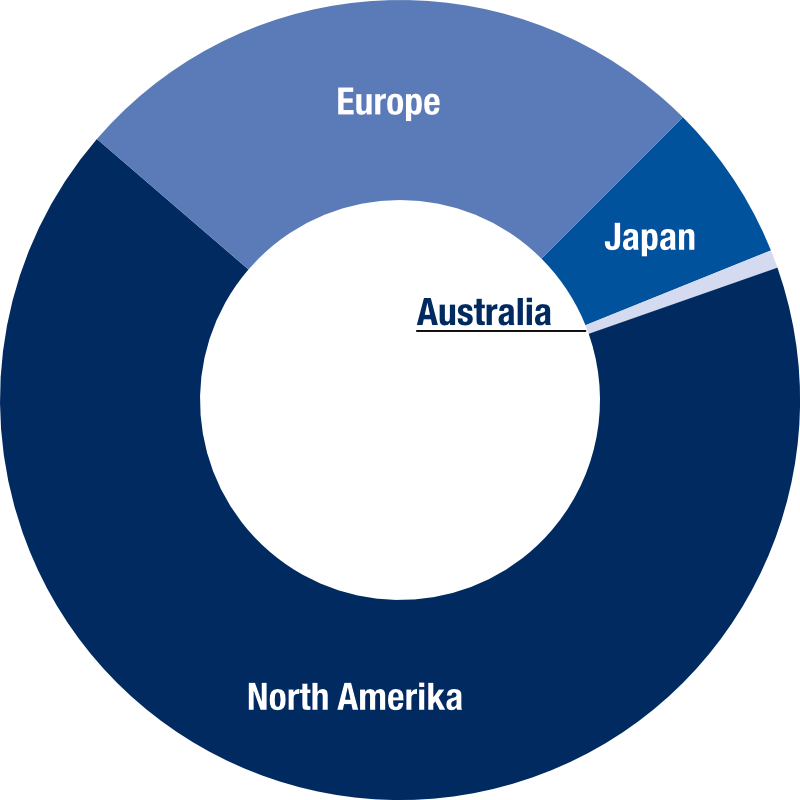

The equity portfolio is globally diversified. The investment universe consists of highly liquid sigle stocks in the established markets of North America, Europe, Japan, Hong Kong and Australia. In the picture: Typical allocation of the individual regions. The current allocation can be found in the monthly published fund fact sheet and may deviate from the schematic representation.

Derivative Instruments in Addition and as an Element of Risk Management

Systematic, rule-based trading in futures (exchange-traded forward transactions), primarily those on stock market volatility, complements the equity strategy on the one hand and is an element of risk management on the other. In calm market phases, the futures strategy can generate additional returns by skimming risk premiums. In stress markets, the strategy seeks to limit losses at the fund level. This is to be achieved by taking rule-based long positions on volatility.

Legal Disclaimer

The contents of this web site are marketing communication. They shall be used exclusively for information purposes and represent neither by Austrian nor by foreign financial market law a solicitation, an offer or an acceptance for the conclusion of a business transaction or any other form of legal act, in particular an investment, and should not influence any such decision. No investment should be made without consultation. The contents must not be interpreted as financial consulting, legal advice or tax consulting. FTC Capital GmbH has provided all information with the highest possible care, using only sources deemed to be reliable. Nevertheless, FTC Capital GmbH accepts no liability for the accuracy, integrity, actuality or ongoing availability of the information provided on FTC’s website.

FTC Capital GmbH accepts no liability for loss or damage, including lost profit or any other direct or consequential damages, arising from the use of or reliance on the information provided on this website. Publishing of information contained therein is prohibited.

Future investors should make use of adequate investment consulting and should acquaint themselves with the applicable legal bases, exchange supervisory authority laws and taxes in their home country or country of residence. In any case, current legal fund documents (offering memorandum, annual reports, semi-annual reports, etc.) should be studied carefully. All fund-specific documents can be ordered free of charge from FTC Capital GmbH, Seidlgasse 36/3, A-1030 Vienna, and from the respective agent (representative) in countries where the funds are registered for public distribution. On request we will announce further institutions which provide fund specific documents as well as the date of the last publication of the offering memorandum in Austria or in jurisdictions in which the funds are authorised for public distribution.

Authorisation for public distribution:

FTC Gideon I: Austria, Germany

FTC Futures Fund Classic: Austria, Luxembourg; in particular public distribution is not allowed in Germany or Switzerland

Smart Volatility Plus: Austria, Germany

Information for the USA:

Investment products and information mentioned on the following pages are not intended for distribution in the US.

Therefore, they do not apply to US residents according to Rule 902, Regulation S, Securities Act 1933 (in particular American citizens or persons permanently resident in the US).

Information for Germany:

Investment product FTC Futures Fund Classic and information mentioned on the following pages in regard thereof are not intended for public distribution in Germany. In this respect the website does not address to citizens of Germany.

Information for Switzerland:

Investment products and information mentioned on the following pages in regard to FTC Futures Fund Classic and FTC Gideon I are not intended for public distribution in Switzerland. In this respect the website does not address to citizens of Switzerland.

Risk disclaimer

Every investment involves risks. Fund prices may rise or fall. Performance data refer to the past.

Past performance is no reliable indicator for future results.

In particular, capital preservation cannot be guaranteed.

Investments in foreign currencies are subject to exchange rate fluctuations and currency risks, which means that the performance of such investments also depends on the volatility of the foreign currency, which can have a negative influence on the capital invested.

Futures Funds: Investments in futures funds can be very profitable, but they can also involve considerable risks that do not, or at least not to the same extent, occur with traditional investment categories and which can lead to a considerable loss, or at worst, the total loss of the investment. Therefore, investors must be prepared and able to accept a complete loss. When purchasing shares in futures funds, a longer-term holding period should be intended with the primary purpose of adding such funds to an existing diversified portfolio.

For FTC Futures Fund Classic and FTC Gideon I this website contains further legal and risk information by using the link “legal remarks” within the respective product menu.