FTC SMART VOLATILITY PLUS provides a hedge for equity investments during stress scenarios such as the Lehman bankruptcy in the fall of 2008 or the outbreak of the Corona pandemic in 2020. Combined with alternative equity exposure during average market periods, the fund offers positive expected returns over the long term.

Smart Volatility Plus: Prices & Performance

SMART VOLATILITY PLUS (EUR R01 T)

ISIN: AT0000A2SRK1

as at 25.04.2024

110,86

Compared to the last NAV

0,05 %

Month

-0,79 %

Year to Date

1,28 %

1 Year

11,13 %

3 Years

n.a.

Inception to Date

11,81 %

Marketing communication. The performance is calculated according to the OeKB method. The performance takes into account the management fee. The one-off front-end load of up to 3% that may be charged at the time of purchase, depending on the distribution channel, and any individual transaction-related or ongoing income-reducing costs (e.g. account and custody account fees) are not included in the presentation. Past performance is not a reliable indicator of a fund's future performance. Source: FTC Database.

The SMART VOLATILITY PLUS shows increased volatility.

SMART VOLATILITY PLUS may invest substantially in exchange-traded futures and demand or callable deposits with maturities of 12 months or less.

The computer system used by FTC employs certain strategies based on the reliability and accuracy of analytical models. If these models (or their underlying assumptions) prove to be incorrect, the performance of the SMART VOLATILITY PLUS may not meet expectations, which could result in substantial losses to the SMART VOLATILITY PLUS and, therefore, to investors.

Volatility long & short

SMART VOLATILITY PLUS applies two quantitative and systematic strategy groups that trade volatility futures: In most market environments, the strategies that take effect are those that skim risk premiums through short volatility exposure in relatively calm market phases. In contrast, during heavy stress phases, short-term and highly weighted long volatility exposure is built up. In combination, we expect a highly positive correlation to the equity market in average market environments and negative correlation and high excess returns in stress markets.

In the investment portfolio, SMART VOLATILITY PLUS is recommended as an add-on suitable to hedge the portfolio's equity exposure against extreme events on the stock market.

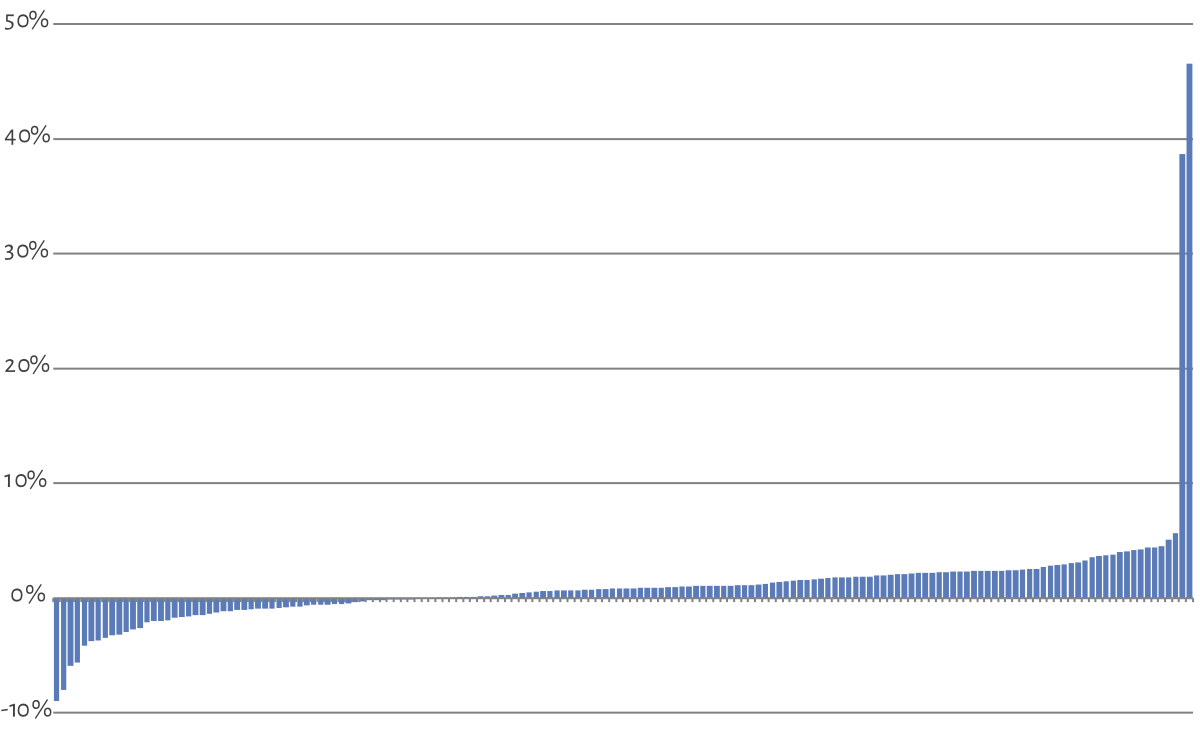

Figure: Distribution of simulated monthly returns between 2007 and August 2021 (sorted by level of monthly returns); simulated performance is not a reliable indicator of future results.

Source: FTC Database.

Investment Information

Smart Volatility Plus ist ein UCITS konformer Investmentfods und wurde am 1. Oktober 2021 gestartet. Er steht sowohl privaten als auch institutionellen Anlegern offen.

DOMICILE

Austria

LEGAL CONSTRUCTION

UCITS

INVESTMENT COMPANY

ERSTE Asset Management

CUSTODIAN

Erste Group Bank AG

MANAGER

FTC Capital GmbH

AUDITOR

Ernst & Young GmbH

LIQUIDITY

Daily

ISINs, SHARE CLASSES

AT0000A2SRK1 | EUR R01 T

AT0000A2SRL9 | EUR R01 VT*

AT0000A2SRF1 | EUR I01 T

AT0000A2SRG9 | EUR I01 VT*

AT0000A2SRH7 | EUR I02 T

AT0000A2SRJ3 | EUR I02 VT*

*accumulating in complete extents for tax non-residents;

MINIMUM INVESTMENTS FOR INITITIAL INVESTMENTS | SUBSEQUENT INVESTMENTS (EUR)

Class R01: None

Class I01: 250,000.- | 25,000.-

Class I02: 1,000,000.- | 100,000.-

Legal Disclaimer

The contents of this web site are marketing communication. They shall be used exclusively for information purposes and represent neither by Austrian nor by foreign financial market law a solicitation, an offer or an acceptance for the conclusion of a business transaction or any other form of legal act, in particular an investment, and should not influence any such decision. No investment should be made without consultation. The contents must not be interpreted as financial consulting, legal advice or tax consulting. FTC Capital GmbH has provided all information with the highest possible care, using only sources deemed to be reliable. Nevertheless, FTC Capital GmbH accepts no liability for the accuracy, integrity, actuality or ongoing availability of the information provided on FTC’s website.

FTC Capital GmbH accepts no liability for loss or damage, including lost profit or any other direct or consequential damages, arising from the use of or reliance on the information provided on this website. Publishing of information contained therein is prohibited.

Future investors should make use of adequate investment consulting and should acquaint themselves with the applicable legal bases, exchange supervisory authority laws and taxes in their home country or country of residence. In any case, current legal fund documents (offering memorandum, annual reports, semi-annual reports, etc.) should be studied carefully. All fund-specific documents can be ordered free of charge from FTC Capital GmbH, Seidlgasse 36/3, A-1030 Vienna, and from the respective agent (representative) in countries where the funds are registered for public distribution. On request we will announce further institutions which provide fund specific documents as well as the date of the last publication of the offering memorandum in Austria or in jurisdictions in which the funds are authorised for public distribution.

Authorisation for public distribution:

FTC Gideon I: Austria, Germany

FTC Futures Fund Classic: Austria, Luxembourg; in particular public distribution is not allowed in Germany or Switzerland

Smart Volatility Plus: Austria, Germany

Information for the USA:

Investment products and information mentioned on the following pages are not intended for distribution in the US.

Therefore, they do not apply to US residents according to Rule 902, Regulation S, Securities Act 1933 (in particular American citizens or persons permanently resident in the US).

Information for Germany:

Investment product FTC Futures Fund Classic and information mentioned on the following pages in regard thereof are not intended for public distribution in Germany. In this respect the website does not address to citizens of Germany.

Information for Switzerland:

Investment products and information mentioned on the following pages in regard to FTC Futures Fund Classic and FTC Gideon I are not intended for public distribution in Switzerland. In this respect the website does not address to citizens of Switzerland.

Risk disclaimer

Every investment involves risks. Fund prices may rise or fall. Performance data refer to the past.

Past performance is no reliable indicator for future results.

In particular, capital preservation cannot be guaranteed.

Investments in foreign currencies are subject to exchange rate fluctuations and currency risks, which means that the performance of such investments also depends on the volatility of the foreign currency, which can have a negative influence on the capital invested.

Futures Funds: Investments in futures funds can be very profitable, but they can also involve considerable risks that do not, or at least not to the same extent, occur with traditional investment categories and which can lead to a considerable loss, or at worst, the total loss of the investment. Therefore, investors must be prepared and able to accept a complete loss. When purchasing shares in futures funds, a longer-term holding period should be intended with the primary purpose of adding such funds to an existing diversified portfolio.

For FTC Futures Fund Classic and FTC Gideon I this website contains further legal and risk information by using the link “legal remarks” within the respective product menu.